Introduction

The description of state budgets is derived from Article 202 of the Indian Constitution, with a process closely resembling that of the federal budget.

In a mixed economy, apart from the private sector, there is the government which plays a very important role. The Government play three distinct functions that operate through the revenue and expenditure measures of the government budget.

First, the Allocation Function —

The allocation function of the government involves public goods like national defence, roads, and government administration, which differ from private goods. These cannot be efficiently supplied through the market and require government provision.

Second, the distribution function —

Through tax and expenditure policies, the government aims to achieve a perceived ‘fair’ distribution of income in society. By making transfer payments and collecting taxes, it has the ability to modify household disposable income and, consequently, impact income distribution.

Third, economy stabilisation —

The economy experiences significant fluctuations, including periods of unemployment and inflation, driven by aggregate demand influenced by private economic agents and factors like income and credit availability. Policy measures are essential to boost aggregate demand during periods of insufficient spending, while times of excess demand and inflation require restrictive measures.

Component of the Government Budget

In every state, there is a constitutional requirement (Article 202) to present a statement of estimated receipts and expenditures of the government to the State Legislature for each financial year, which spans from April 1st to March 31st.

This statement, known as the ‘Annual Financial Statement,’ serves as the primary budget document.

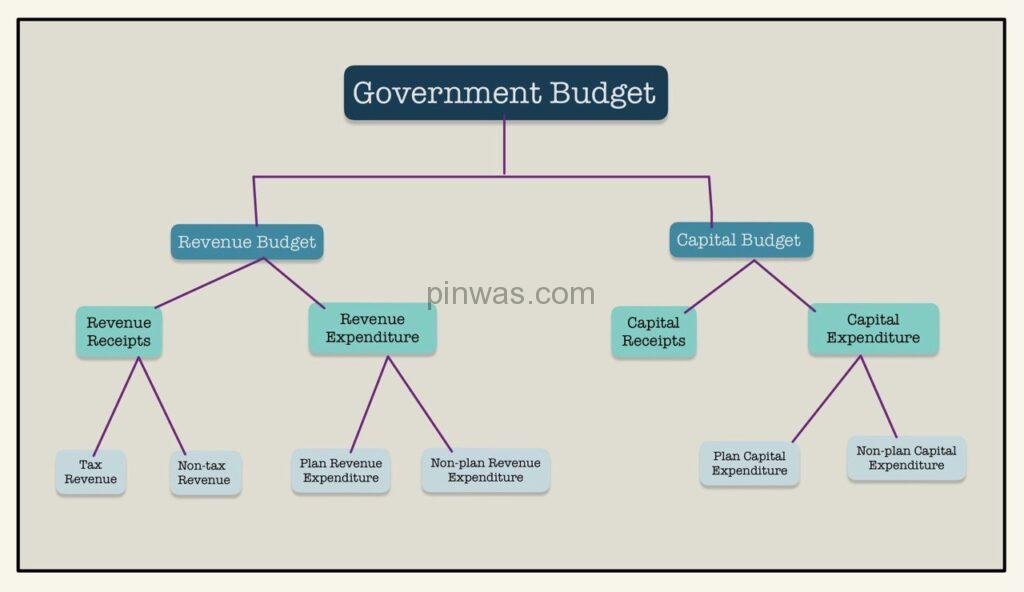

The budget is divided into two main categories:

- Revenue Budget

- Capital Budget

It is essential for the budget to distinguish between expenditures on the revenue account and other forms of expenditures.

The Revenue Account

The Revenue Budget shows the current receipts of the government and the expenditure that can be met from these receipts.

Revenue Receipts

Revenue receipts are receipts of the government which are non-redeemable, that is, they cannot be reclaimed from the government. They are divided into tax and non-tax revenues.

- Tax revenues consist of the proceeds of taxes and other duties levied by the government. Tax revenues, an important component of revenue receipts, comprise of direct taxes which fall directly on individuals (personal income tax) and firms (corporation tax), and indirect taxes like excise taxes (duties levied on goods produced within the country) customs duties (taxes imposed on goods imported into and exported out of India) and service tax. Other direct taxes like wealth tax, gift tax and estate duty (now abolished) have never been of much significance in terms of revenue yield and have thus been referred to as paper taxes.

- Non-tax revenue of the state government mainly consists of interest receipts on account of loans by the state government, dividends and profits on investments made by the government, fees and other receipts for services rendered by the government. Cash grants-in-aid from Union and international organisations are also included.

The estimates of revenue receipts take into account the effects of tax proposal made in the Finance Bill.

Revenue Expenditure

Revenue Expenditure is expenditure incurred for purposes other than the creation of physical or financial assets of the government. It relates to those expenses incurred for the normal functioning of the government departments and various services, interest payments on debt incurred by the government, and grants given to other parties (even though some of the grants may be meant for creation of assets.)

Budget documents classify total expenditure into plan and non-plan expenditure. Within revenue expenditure, a distinction is made between plan and non-plan. According to this classification, plan revenue expenditure relates to Plans (the Five-Year Plans). Non-plan expenditure, the more important component of revenue expenditure, covers a vast range of general economic and social services of the government. The main items of non-plan expenditure are interest payments, subsidies, salaries and pensions.

The Capital Account

The Capital Budget is an account of the assets as well as liabilities of the central government, which takes into consideration changes in capital. It consists of capital receipts and capital expenditure of the government. This shows the capital requirements of the government and the pattern of their financing.

Capital Receipts

All those receipts of the government which create liability or reduce financial assets are termed as capital receipts. The main items of capital receipts are loans raised by the government from the public which are called market borrowings, borrowing by the government from the Reserve Bank and commercial banks and other financial institutions through the sale of treasury bills, loans received from foreign governments and international organisations, and recoveries of loans granted by the central government.

Capital Expenditure

There are expenditures of the government which result in creation of physical or financial assets or reduction in financial liabilities. This includes expenditure on the acquisition of land, building, machinery, equipment, investment in shares, PSUs and other parties.

The budget is not merely a statement of receipts and expenditures. Since Independence, it has also become a significant state policy statement.

Measures of the Government Deficit

Budget deficit is a situation where budget receipts are less than budget expenditures. This situation is also known as government deficit.

When a government spends more than it collects by way of revenue, it incurs a budget deficit. There are various measures that capture government deficit and they have their own implications for the economy.

In reference to the Indian and States Government budget, budget deficit is of four major types :

(a) Revenue Deficit

(b) Budget Deficit

(c) Fiscal Deficit, and

(d) Primary Deficit

(A) Revenue Deficit

It refers to the excess of the government revenue expenditure over revenue receipts. It does not consider capital receipts and capital expenditure. Revenue deficit implies that the government is living beyond its means to conduct day-to-day operations.

[A] Revenue Deficit

The revenue deficit refers to the excess of government’s revenue expenditure over revenue receipts —

Revenue deficit = Revenue expenditure – Revenue receipts

[B] Budget Deficit

Budget deficit is the difference between total receipts and total expenditure (both revenue and capital)

Budget Deficit = Total Expenditure – Total Revenue

[ C] Fiscal Deficit

Fiscal deficit (FD) = Budget deficit + Government’s market borrowings and liabilities

[D] Primary Deficit

Primary deficit is equal to fiscal deficit minus interest payments. It shows the real burden of the government and it does not include the interest burden on loans taken in the past. Thus, primary deficit reflects borrowing requirement of the government exclusive of interest payments.

Primary Deficit (PD) = Fiscal deficit (PD) – Interest Payment (IP)

Budgetary Procedure

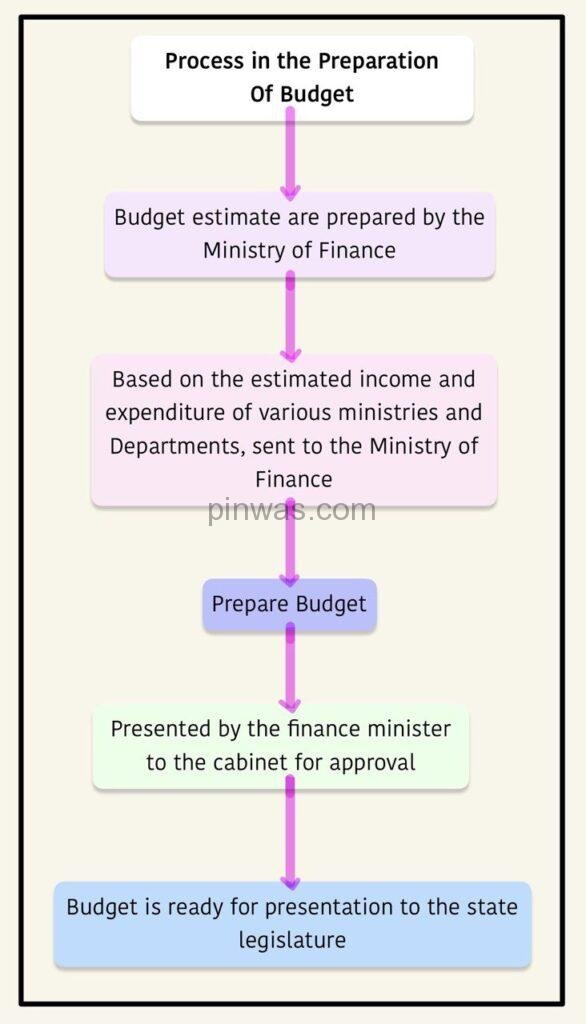

Budgetary procedure refers to the system through which the budget is prepared, enacted and executed.

- Preparation of Budget:

- Presentation of the Budget :

at state levels, the Hon’ble Finance Minister of the respective State Government places the State Budget before the State Legislature.

- Execution of the Budget :

The budget is mainly executed by different departments of the Government. Proper execution of the budgetary provisions are important for the efficient utilisation of the allocated funds.

Three sets of figure

Every budget gives three sets of figures :

- Actual figures for preceding year;

- Budget and received figures for the current year; and

- Budget estimates for the following year.